The International Energy Agency’s (IEA) World Energy Investment 2022 report, published in June, reveals a welcome increase in clean energy investment, but also a rise in geopolitical uncertainty.

The primary finding is that, while robust, energy transition investment is still falling short of that required for a net zero carbon world in 2050. Moreover, investment in traditional areas of energy supply, including oil and gas, has been weak, leading to a lack of supply and high prices, which have hit hardest the most vulnerable in society.

“Investment to bring more clean and affordable energy into the system is rising, but not yet quickly enough to forge a path out of today’s crisis or to bring emissions down to net zero by mid-century,” the IEA says.

Flashing red

The agency says the warning signs surrounding global energy investment were already ‘flashing red’ before Russia’s invasion of Ukraine, but this has added a further layer of uncertainty.

The report says energy investment is expected to increase by 8% this year to reach $2.4 trillion, well above pre-Covid levels, but that half of this reflects higher prices.

Wind and solar costs, after years of decline, are up by between 10% to 20%. The IEA is clear that wind and solar power remain the cheapest options for new power generation, owing to much higher rises in fossil fuel prices. However, higher costs – both for raw materials and borrowing — act as a brake on investment plans.

Power sector closest to sustainable pathway

Nonetheless, clean energy investment is picking up, accounting for almost three-quarters of the growth in overall energy investment. The main boost in recent years has come in spending on the power sector, in terms of increased renewable energy capacity, grid investment and end-use efficiency.

Solar PV makes up almost half of new investment in renewable power, while spending on wind is shifting to the offshore sector, which saw a record year for deployment in 2021. Investment in battery energy storage is hitting new highs and sales of electric vehicles more than doubled in 2021, compared with the previous year.

According to the IEA, power sector spending is the closest to a sustainable trajectory. If today’s spending levels continue to grow out to 2030 at the same rate as over the last three years, it would be enough to meet existing climate pledges. However, even in the power sector, spending still needs to rise substantially to be aligned with net zero emissions by 2050.

The fossil fuel dilemma

A lack of spending on fossil fuel supply has contributed to the current energy crisis, the IEA says. Oil and gas producers face a dilemma for long-life investments; more supply is needed now, but may not be later on as the energy transition progresses. Spending on fossil fuels and low-carbon fuel supply, in aggregate, remains below pre-pandemic levels, the IEA says.

Moreover, the energy crisis has prompted new investment, but not in ways compatible with a net zero future. Investment in coal supply rose 10% in 2021 and is expected to increase by the same amount this year.

Russia’s invasion of Ukraine means some new investment in fossil fuel supply is necessary, including new LNG infrastructure, even in world working towards net zero, the agency says. However, it warns that “the lasting solutions to today’s crisis lie in speeding up clean energy transitions via greater investment in efficiency, clean electricity and a range of clean fuels.”

Rich versus poor

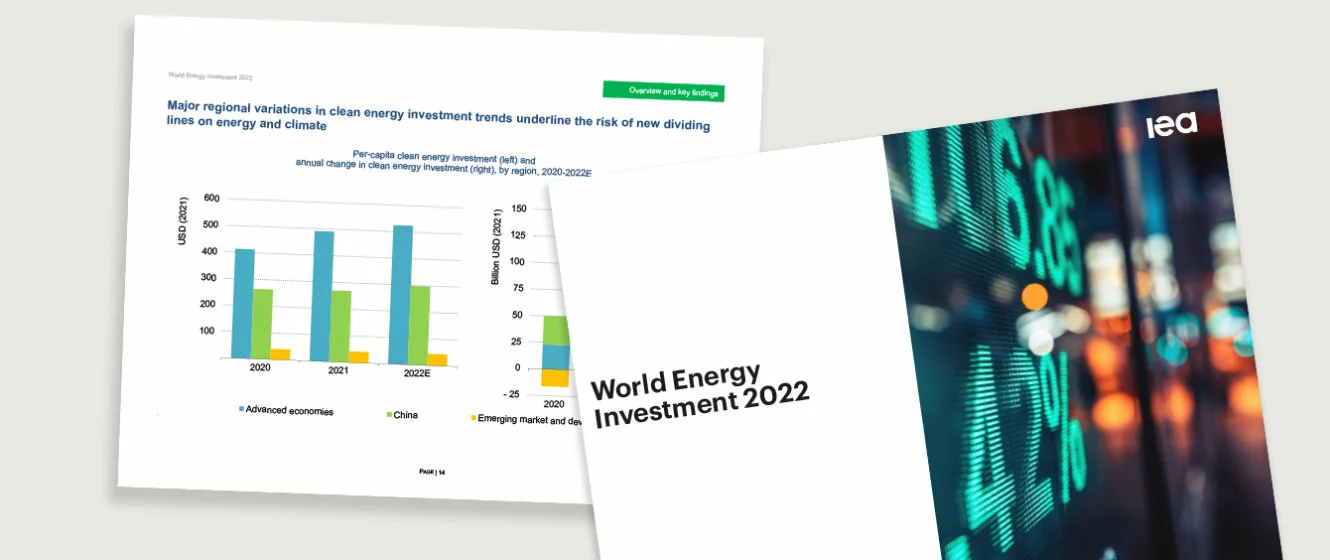

The increase in clean energy investment is heavily concentrated in advanced economies and China, running the risk of new lines of division arising between countries and regions, the IEA says.

Clean energy spending in emerging and developing economies, excluding China, remains stuck at 2015 levels. Higher interest rates are reducing government and consumer spending power and affecting the cost of energy transition technologies, which tend to be capital intensive.

In one its most stark warnings, the IEA says: “There is a real risk that today’s energy crisis will push millions back towards energy poverty. […] Accelerating investment across all aspects of energy transitions in developing economies needs to be a first-order priority, including for international financial institutions, their donors, multilateral development banks and many other actors.”