Batteries are playing an ever-important role as electrification of transport increases. Today, most lithium-ion battery cells are supplied by Asian manufacturers. However, Europe has already picked up the pace in an attempt to play catch-up. Policymakers and industry representatives want to move away from reliance on imports and are ramping up production capacities. In part 1 of our miniseries, en:former analysed Germany’s expansion plans based on the nation’s automobile industry, the most important future market on the continent. In this second instalment, we will be casting our gaze to other European countries.

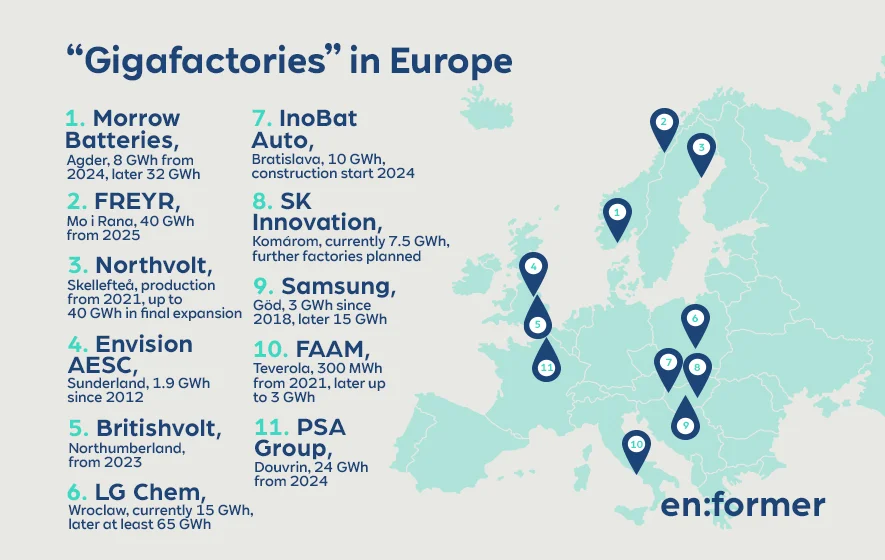

Changes to business in Europe are set to be truly electrifying. In fact, the coming years will likely be marked by a veritable battery boom for the continent, where numerous firms are turning to lithium-ion cells. A number of these companies have emerged as joint ventures or subsidiaries of automobile manufacturers and technology companies, whilst others again have only just been founded. Established Asian manufacturers are also taking the market by storm. According to market research company Benchmark Mineral Intelligence (BMI), battery cell production capacity could increase to 300 gigawatt hours (GWh) by 2030. In doing so, numerous countries have their sights set on becoming veritable battery strongholds.

Scandinavia

The Scandinavian peninsula is not only becoming a key location for European battery production, but also a centre for innovation. In Norway and Sweden, numerous companies are pursuing ambitious plans. They want to make best use of Scandinavia’s favourable conditions: the region’s electricity mix, dominated by wind and hydropower, allows for batteries to be manufactured with a small carbon footprint. Then there are the natural deposits of important raw materials such as graphite and nickel. The companies in this overview are also intent on exploring new technologies. They want to develop more powerful, resource-efficient and cheaper battery storage solutions for the European market.

Morrow Batteries, a Norwegian start-up founded in 2020, is planning a battery cell factory with a capacity of 32 GWh in the southern Norwegian region of Agder. The founders have found a convenient location (port, airport) in Eyde Energipark, an industrial park in the municipality of Arendal. Construction of the factory is scheduled to begin in 2023. The first of four planned construction phases, with each phase adding eight GWh, will be completed as early as 2024. According to the company, this will create up to 10,000 jobs in the region.

Morrow Batteries was founded by Norwegian energy company Agder Energi and investor Bjørn Rune Gjelsten, and its list of partner companies numbers national research institutes. Together, they not only plan to specialise in lithium-ion cell manufacturing for the automotive and marine industry, the plant will also include a research centre for experts to work with lithium-sulphur technologies, using waste from the Norwegian oil industry. The entrepreneurs have also announced their plans to take a new, sustainable approach to battery production.

Way up in the north lies the self-proclaimed ‘green industrial capital of Norway’, Mo i Rana. Heavy industry has shaped the region for over 100 years and now, Norwegian battery company FREYR is planning to build a battery factory here in partnership with cell specialists 24M Technologies. The company has developed a new, low-cost method for manufacturing lithium-ion cells, which are simpler in design and rely on a semi-solid electrolyte rather than a liquid variant.

These ‘semi-solid’ cells will go into production in Mo i Rana in 2025 at a capacity of 40 GWh, according to FREYR. The electricity for the factory will come from on-site wind and hydroelectric power plants, among other sources. Even before the ‘gigafactory’ goes into operation, the start-up plans to produce its first batteries at a two-GWh ‘fast track’ plant.

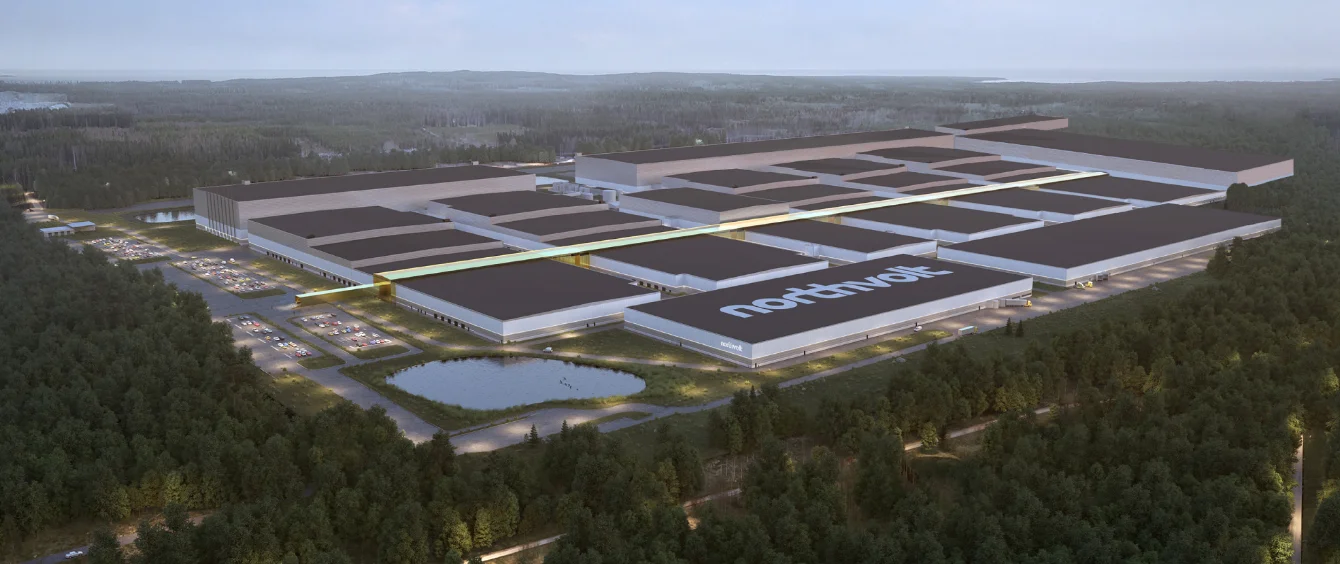

Peter Carlsson founded the company Northvolt in 2016, which today already has over 500 employees. The former Tesla manager is focussed on sustainably producing lithium-ion batteries, supplying large corporations such as Volkswagen (VW) with his products. The group also owns shares in Northvolt. He’s currently building his first ‘gigafactory’ in Skellefteå in northern Sweden, which will go into operation before the end of 2021.

Material production, assembly of cells, recycling – all this will one day take place under one roof at the company’s main site. With a capacity of up to 40 GWh following its final expansion stage, the plant will be one of the largest of its kind in Europe. Renewables will provide the huge amounts of electricity needed for production. The factory serves as a blueprint for a second site in Salzgitter, which will manufacture batteries for VW’s e-cars, among other products, from 2024 onwards.

United Kingdom

The automobile industry has traditionally played a key part in the British economy, where more than 1.3 million cars roll off assembly lines every year – most of which headed for export. In addition to domestic brands such as Mini and Rolls Royce, Asian manufacturers including Nissan and Toyota have also built plants on the island. Recently, however, production has slowed. Establishing battery factories could counteract this trend and create new jobs. Nissan, for example, is planning on expanding its battery plant in the port city of Sunderland, although it has chosen to relocate a part of its car manufacturing operations to Japan. Domestic buyers, proximity to the EU market and the island’s green power mix (with a growing share of offshore wind) all speak in favour of choosing the UK.

Sunderland, in the north-east of England, has been home to a factory supplying batteries to its neighbour, a Nissan plant, since 2012. The former Nissan battery subsidiary AESC, which now belongs to Chinese firm Envision Group, makes batteries for the Japanese carmaker’s e-cars on site under the name Envision AESC. According to the company’s own statements, the site has a capacity of 1.9 GWh. Production is to be expanded in the coming years and a viability study funded by the UK government will assess the site’s potential.

Britishvolt is another start-up entering the European battery market with plans to build a plant in the sleepy English town of Blyth, Northumberland. Set on the site of a former coal-fired power station, construction is to begin as early as summer 2021 with a view to producing the first lithium-ion batteries there in 2023. Funding in the amount of 2.6 billion pounds has been earmarked for the occasion – one of the largest subsidies in the history of British industry. As of yet, Britishvolt hasn’t released any details on planned capacity, but it will be the “first gigafactory in the UK”.

Blyth, once an important port town, boasts particularly favourable conditions for the company. The location, by the North Sea directly at the mouth of the River Blyth, is convenient for exports. Electricity for production will be covered by renewable energy, mainly hydroelectric power from Norway. In fact, the world’s longest subsea interconnector, the North Sea Link, connects Blyth directly to its Scandinavian energy supply.

Eastern Europe

Many car companies choose to build their vehicles in Eastern Europe, partly as they benefit from lower labour and production costs. These advantages and the proximity to customers are now also attracting battery manufacturers. Asian companies have shown a preference for expanding into Poland or Hungary, allowing them to become part of an emerging industry with favourable conditions. However, as the electricity mix in these Eastern European countries relies heavily on fossil fuels, whilst renewables have thus far taken a back seat, this makes local cell manufacturing very CO2-intensive.

South Korean chemical company LG Chem’s European headquarters are located in Wrocław, to the south-west of Poland. The factory already produces lithium-ion cells and entire battery packs across 50 production lines. The site has a capacity of 15 GWh, which is to increase steadily over the coming years – to at least 65 GWh. LG batteries are installed in e-cars from VW, Renault and Hyundai, among others. In addition to this Polish plant, the group also operates at sites in South Korea, China and the USA.

Another ‘gigafactory’ is being built in the Slovakian capital Bratislava. The battery producer InoBat Auto wants to start pilot production of its first cells before the end of 2021. Construction of a ten-GWh factory is set to begin in 2024. The company wants to develop cells in a research centre in the municipality of Voderay, also in Slovakia, which are tailored to the individual performance requirements of its customers. The Bratislava plant is expected to deliver up to 240,000 of these ‘customised’ batteries for the automotive industry. InoBat Auto is also looking into recycling. The company is planning a commercial-scale plant that will process scrap batteries to recover raw materials.

First one, then two, now three? That’s how many factories the South Korean battery manufacturer SK Innovation is intent on building in Hungary. A 7.5 GWh lithium-ion battery plant is already stationed in the town of Komárom in northern Hungary, and plans are already in motion to have built another there by 2022. Although construction has only just begun, the company has already announced it is on the market for a suitable location for a third Hungarian plant. The Eastern European country is also home to Daimler and Audi production sites, making it attractive to cell specialists such as SK Innovation.

Samsung is another South Korean technology group to make best use of the Hungary’s location advantages. In 2018, the company converted a former television manufacturing factory in Göd, near Budapest, into a battery plant. Production is already underway, but the plant is expected to continue to grow, increasing capacity from three to 15 GWh.

Southern and western Europe

Projects in the south-west of the continent can’t compete with ambitious plans such as those in Scandinavia and Eastern Europe. Nevertheless, the region’s first projects are also already underway. France’s first ‘gigafactory’, for example, is currently being built alongside several research centres, construction of a cell factory is about to begin in Italy and Spain will soon see the PSA Group assembling lithium-ion cells from China into battery packs in its first automotive plant.

The southernmost factory in our overview is being built in Italy. In the town of Teverola, northwest of Naples, FAAM, an Italian battery manufacturer with a long tradition, is planning a complex of two plants. The first construction phase is scheduled to begin in Q1 of 2021. According to the company, the site will have a capacity of 300 MWh. Another block will be built on the site by 2027. It will initially be used for research and development. Later, it will be used to produce lithium-ion cells with 2.5 to three GWh.

Saft, a subsidiary of Total, and the PSA Group, car manufacturer Opel’s parent company, have begun construction at two separate sites, simultaneously: in Kaiserlautern, Germany, and Douvrin, northern France. When completed, both factories will have a capacity of 24 GWh. The first e-car batteries are expected to roll off assembly lines in 2024.

France’s Ministry of the Economy and Finance and the German Federal Ministry of Education and Research are subsidising the project: at least 1.3 billion euros in subsidies have been allocated to the 5-billion-euro project launched by the joint venture, Automotive Cells Company (ACC). Securing Europe’s independence from Asian manufacturers is not the only aim of these ‘gigafactories’. According to ACC, 35 percent less CO2 will be released during battery production here than in China or South Korea.