Emissions trading is considered to be the most economically viable instrument for reducing greenhouse gas emissions. And no such tool is more accurate than an emissions trading system (ETS).

In 2005, the European Union was the first political entity to introduce such a scheme (EU ETS) – initially intended only for the energy and energy-intensive industry sectors, from 2012 it also applied to air transport within the EU, setting an example to the rest of the globe. The International Carbon Action Partnership (ICAP) recently listed 20 emissions trading schemes worldwide in its 2019 Status Report.

The cost-efficient way to lower emissions

All such systems premise one communal idea: Within a defined market, all players together may emit a certain amount of CO2 over a certain period of time. Which party is allowed to emit how much is regulated by supply and demand: Each party must redeem a corresponding number of certificates in relation to the emissions for which it is responsible. It receives these emission allowances either by allocation or by purchasing them.

It is essential that the certificates are tradable: Participants looking to emit large quantities of greenhouse gases need numerous certificates, which means they must purchase them. Whereas participants with the ability to inexpensively avoid emissions can save money or even make a profit by selling the certificates they are allocated – in direct trading or on an energy exchange.

Critics claim that the EU ETS failed because the comparatively low CO2 price was not able to attract enough climate protection investors. However, the fact remains that the sectors covered by the EU ETS are the only industries to have significantly reduced their emissions in recent years. The ICAP authors have learned: “Although robust carbon prices are important drivers for low-carbon investment, the key determinant of the mitigation impact of an ETS is its cap trajectory.”

Same but different: Same principle, with a facelift

The flexibility of the ETS concept is demonstrated by the wide range of existing versions: In Japan, the prefecture of Tokyo (2010) and its neighbour Saitama (2011) have obliged owners of commercial and industrial buildings to reduce their emissions. Kazakhstan, on the other hand, has been capping carbon dioxide emissions from the industrial, energy and mining sectors since 2013. According to ICAP, Kazakhstan’s ETS thus covers half of its CO2 emissions.

The most developed ETS undoubtedly belongs to New Zealand, where companies in the transport sector, which covers air traffic, as well as the construction, waste management and forestry industries, must acquire emission allowances in addition to energy and industrial corporations. Although the ETS does not yet apply to agricultural ventures, they are already obligated to document their emissions.

While the EU is reluctant to extend its ETS to include other sectors such as transport and buildings, New Zealand has been sharing the responsibility for hitting climate change targets between more industries than any other ETS since 2013.

Interest in the concept of ETSs is on the rise – in China and the US as well

According to the ICAP report, eight percent of all global emissions are currently subject to an ETS. But, it also says that things are changing: “The more states search for ways in which to reach Paris climate targets, the more the interest in setting prices on emissions within the scope of an ETS has increased in recent years.”

The Beijing-based Ministry of Ecology and Environment recently announced its plans to establish a national CO2 market. By 2013, China had already set up and successively expanded local ETSs in seven major cities as well as in the Fujian region. Beijing and Shanghai, for example, have gradually included other sectors and lowered the inclusion threshold in order to encompass more corporations. ICAP calculates that with a national ETS in China,14 percent of global greenhouse gas emissions would be tariffed.

The US state of California and the Canadian province of Québec have shown that the integration of several ETSs can also prove to be largely successful. Both had previously joined the Western Climate Initiative, a non-profit company, and gone on to each set up an ETS by January 2013. Since 2014, California and Québec have operated a joint cap-and-trade system.

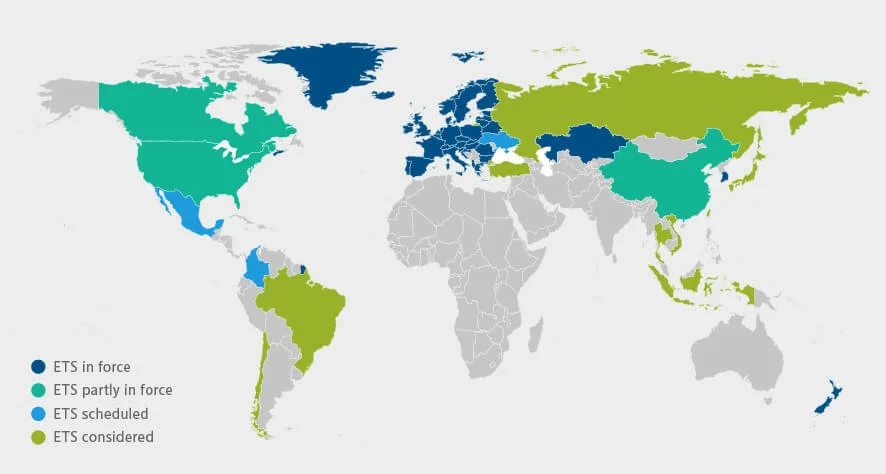

There are many states and regions looking into or operating with the ETS concept.