According to US news portal Bloomberg, in early 2019, power producers in Europe and the US used less coal and more natural gas than in the same months of last year. A mild winter and high production volumes had caused natural gas prices to drop so radically that coal as an energy source for electricity generation was forced off the market to a certain extent.

This was most evident in Germany, where lignite consumption fell by 16 percent year-on-year from January to May, with hard coal usage dropping by as much as 22 percent. Gas-fired power stations had simultaneously increased their production levels by 16 percent. In addition to the decline in gas prices, Bloomberg also sees the price hikes for EU emissions trading (ETS) certificates as a driving factor of this development.

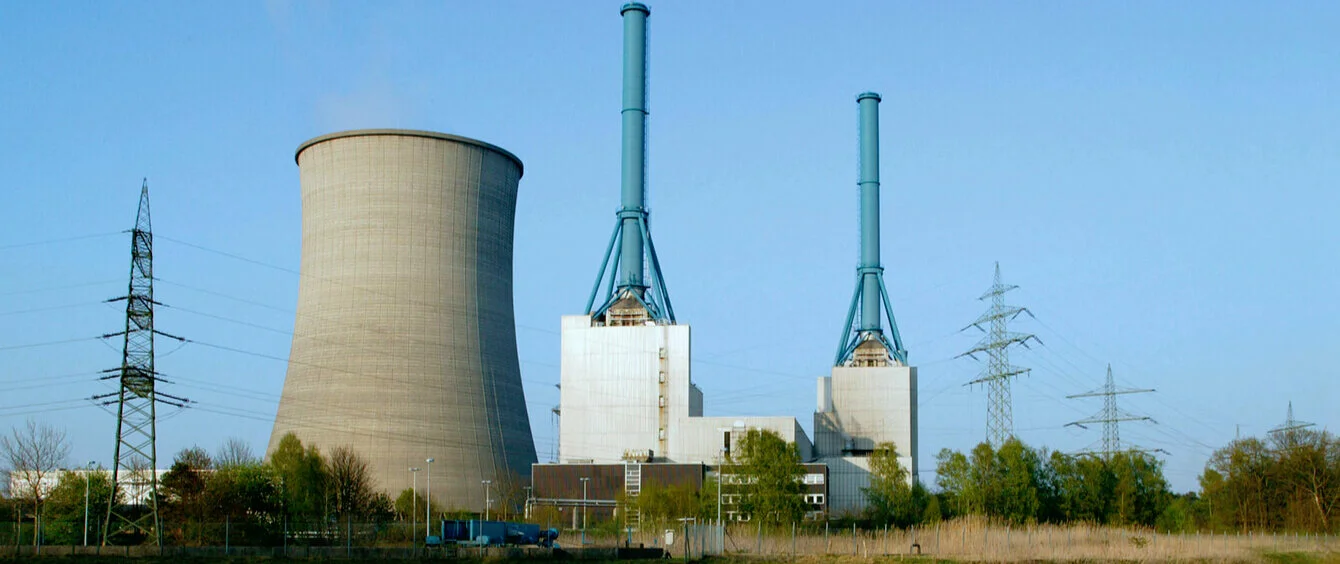

More gas, less coal

Changes in Consumption for Power Generation 2018/2019 in percent (Source: EEX, EIA, Bloomberg).The information service confirmed this theory with Andree Stracke, Chief Commercial Officer of RWE Supply & Trading: “Markets work and I like the ETS because it’s defining a clear carbon dioxide reduction. It delivers as promised.”

Both the US and China are increasingly turning to natural gas

Emissions trading also exists in the USA, but these systems are limited to certain regions or states. Nevertheless, according to Bloomberg, US power producers have also reacted to the changing prices. In the first quarter of 2019, power generation from coal decreased state-side by 7.8 percent, while production from gas-fired power stations increased by ten percent.

Even China was now increasingly turning to gas, according to Bloomberg. Demand of the world’s largest carbon emitter will increase by 12 percent over the course of 2019, in-house analysts estimate.

CO2 pricing helps with the ‘fuel switch’

The ‘fuel switch’ is considered to be an integral transitional strategy in order to reach climate goals. Greenhouse gas emissions can be significantly reduced since gas emits about half as much carbon dioxide as coal during combustion. At the same time, gas-fired power plants can react more flexibly to fluctuations in demand than coal-fired power plants. The biggest obstacle so far has been the comparatively high price of the volatile fuel.