South Korea looks set to become a member of the emerging cluster of north Asian countries embarking on major offshore wind expansions as it accelerates its plans to reduce its dependence on coal-fired generation. Speaking at the first International Day for Clean Air for Blue Skies in September, South Korean President Moon Jae-in announced that his government would close ten coal plants by the end of 2022 and a further 20 by 2034.

To compensate for the loss of generation capacity, Moon said solar and wind energy would triple by 2025. This means a jump from about 10 GW of solar at the end of 2019 to more than 30 GW and a rise from 1.5 GW for wind to more than 4.5 GW.

Green New Deal

However, this is likely to be only the start of the country’s renewable energy ambitions. In July, the government announced a target of 12 GW of offshore wind capacity by 2030. President Moon said that his government would develop a roadmap for carbon neutrality by 2050 by the end of the year, and set new greenhouse gas emissions targets for 2030. This would be the first net zero carbon plan by 2050 in the region.

In addition, as part of his post-Covid 19 ‘Green New Deal’, Moon has proposed an end to financing coal projects and the introduction of a carbon tax.

Powerhouse of the future

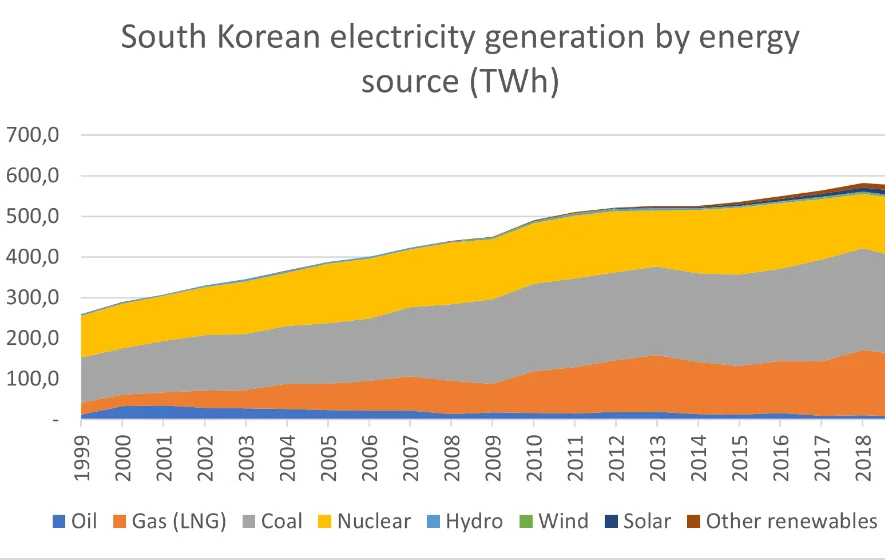

The move away from coal is a major turnaround for South Korea, the world’s fourth largest importer of the fuel, which largely powered the nation’s industrialisation in the latter half of the 20th Century. Last year, coal generated 41.5% of the country’s electricity. South Korea faces a very similar challenge to Japan and Taiwan, which are also embracing the potential of offshore wind. All three are advanced economies with energy systems characterised by a lack of domestic fossil fuel resources, little hydro power and the adoption of nuclear power as a means of offsetting their consequent heavy dependence on imports of coal and LNG.

How far and how quickly renewables are deployed will in part depend on the countries’ attitudes to nuclear power. While Japan looks set to continue with nuclear accounting for a significant, if reduced, share of its power generation, both Taiwan and South Korea intend to phase nuclear out. However, South Korea’s nuclear plans are gradual, taking place over 45 years and achieved by denying new build licenses and license renewals for existing reactors.

Offshore opportunity

It is to wind and solar power that Seoul is turning to replace the decline in coal and nuclear generation. South Korea currently has just 98 MW of offshore wind capacity in operation, comprising the 30 MW Tamra wind farm of Jeju Island, a 60 MW development near Buan off North Jeolla province (a pilot for the much larger southwestern North Jeolla wind farm project) and 3 pilot turbines in Jeju and Gunsan totalling 8 MW capacity. However, the country is not looking at wind power only for domestic use. The government’s proposal to end financing for coal projects would affect some of its major companies’ exports. South Korea is the third biggest public investor in overseas coal plants.

As a result, the country’s heavy engineering companies are looking to grab a share of the emerging north Asian offshore wind market and potentially beyond.

Doosan Heavy Industries and Construction, for example, has emerged as the first South Korean manufacturer of offshore wind turbines. The 2 MW turbines for the North Jeolla and Tamra projects were supplied by the company, which sourced 70% of the turbines’ components domestically. Doosan is targeting offshore wind market sales of more than 1 trillion won (€728 billion) by 2025, viewing the sector as a major future source of revenues and employment. The company’s 5 MW turbine has gained international certification and it expects to have an 8 MW model on the market in 2022.

Scaling up

With pilot plants in operation and offshore wind costs on a sharp downward trajectory, South Korea hopes to scale up deployment over the next decade. 7 GW of capacity is expected to start construction in the next ten years and the complete project pipeline totals over 11 GW.

Work started this summer on the southwestern North Jeolla wind power project, which will have total capacity of 2.4 GW. All phases are expected to be complete by 2028. In addition, Ulsan province has signed a number of memoranda of understanding with foreign and domestic investors to develop offshore wind farms. Renewable energy in South Korea is supported by the government’s Renewable Portfolio Standard, which obliges generators with capacity of more than 500 MW to increase gradually the proportion of renewable energy in their portfolios. The target for 2020 is 7%, rising to 10% in 2023.

Offshore potential

Both traditional fixed-base installations and floating wind farm concepts have been proposed, reflecting South Korea’s shallow and deep water potential. According to the International Energy Agency’s (IEA) Offshore Wind Outlook 2019, South Korea has the technical potential to generate 27 TWh a year from near-shore projects in shallow water. These areas will be exploited first as near-shore, shallow-water sites are likely to prove the most cost effective, owing to lower construction costs and shorter distances to shore for transmission lines.

From there, the IEA estimates the country has an additional 586 TWh/yr potential from far-shore, shallow-water areas, roughly equivalent to its total electricity generation from all sources last year. Moving into deeper waters could add 366 TWh/yr near shore and 2,068 TWh/yr far shore.