Will ‘Made in Europe’ soon replace ‘Made in China’? This could actually happen when it comes to solar cells. Asian manufacturers may have dominated the global market for years, but Europe-based companies plan to increasingly grow solar cell production. This trend is being driven by the significant expansion of solar capacity, with innovation playing an even greater role. Technological progress has recently driven down PV costs noticeably. In fact, prices have fallen so much that transport costs are increasingly gaining significance for plant manufacturers. This is good news not only for the European solar sector, but also for the carbon footprint of solar cells. Given that renewables account for a higher share of the electricity mix in most European countries than in China, energy-intensive production would release less greenhouse gas. Reports of poor working conditions in the People’s Republic also play a role.

Solar energy is experiencing a boom in Europe. Based on the latest figures from the International Renewable Energy Agency IRENA, PV units with a total capacity of nearly 21 gigawatts (GW) were built last year, with 4.7 GW being located in Germany alone. Aggregate capacity has thus risen to 161 GW. Industry association SolarPower Europe predicts growth accelerating further in the years ahead. In its market outlook published at the end of 2020, it forecasts an increase in build-out in the EU-27 of 22.4 GW in 2021, 27.4 GW in 2022, 30.8 GW in 2023 and 35 GW in 2024. This would increase demand for PV modules – an opportunity that European manufacturers could seize.

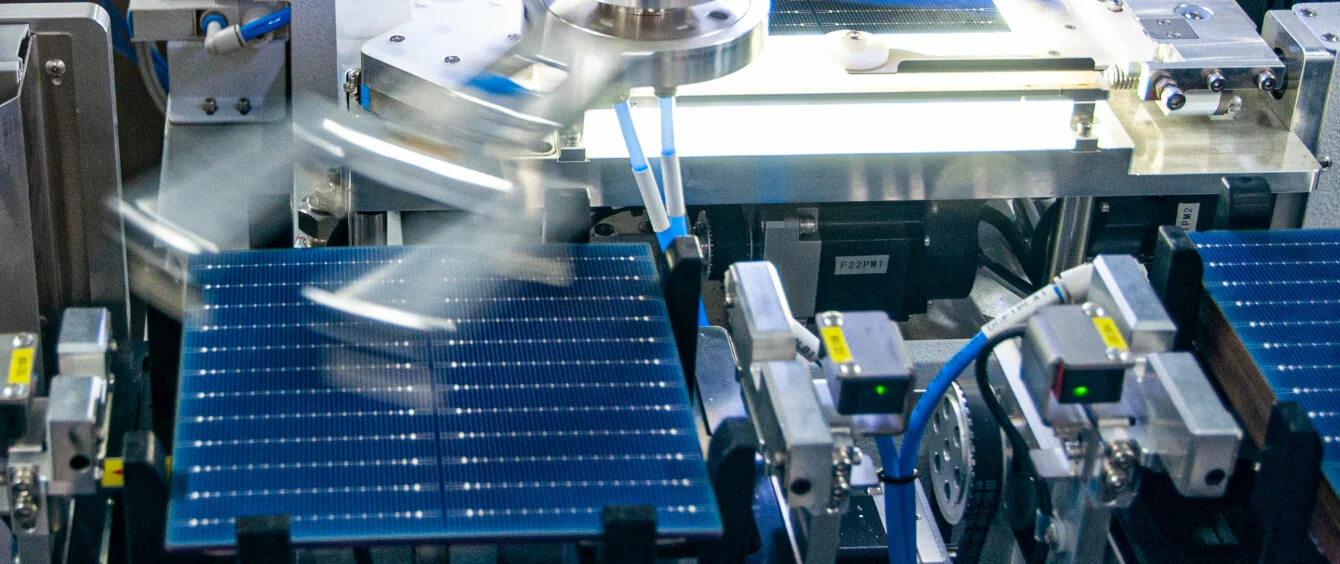

European companies are already innovation trailblazers and own patents on cutting-edge technologies, including heterojunction cells. A special method is used to coat solar cells with silicon, giving them an efficiency of about 24 percent. This makes them the most powerful on the market, and further efficiency gains are achieved if they are connected to each other using smart wire, which is made up of a plurality of thin copper leads. Such wires are an effective alternative to customary conductors and require less raw material such as silver. One player implementing this concept is Swiss-based Meyer Burger Technology AG, the world market leader in the mechanical engineering of PV production.

Innovative ideas for numerous applications

In addition, various applications are being refined in Europe, such as the agri-PV solution by German startup Next2Sun, involving vertically ground-mounted solar modules, and the solar tubes by TubeSolar, which when set up on farmland produce electricity while protecting crops from hailstones. “Innovation is one of the drivers of the steady growth of solar energy in Europe. Applications going beyond rooftop installations, such as PV integrated in buildings and agri-PV, mean that solar panels can be used in all structures and on all terrains,” says Aurélie Beauvais, Policy Director and Deputy Managing Director at SolarPower Europe.

Therefore, the prospects of Europe’s solar industry returning to its path for success and experiencing a renaissance are fairly bright. Until about ten years ago, Europe had several production centres for solar cells, above all in Germany. Thanks to the substantial subsidisation under the Renewable Energy Act, German companies had built significant production capacity in locations such as the country’s Solar Valley in Bitterfeld-Wolfen in the state of Saxony-Anhalt. Dropping feed-in fees and rising competition on the global market plunged many companies into difficulty. Renowned outfits filed for insolvency starting in 2012, failing to compete with manufacturing costs on the Asian market.

Costs take nose dive

According to research and data platform Our World in Data, a megawatt hour (MWh) of solar power cost 40 dollars in 2019. Ten years earlier, electricity generations costs stood at 359 dollars. This huge 89 percent decline in price, which was primarily triggered by technological advances, has turned solar power into the most affordable form of electricity of all time (in terms of generation costs). Due to the constant decline in the price of PV modules, with manufacturing costs totalling a mere 20 euro cents per watt peak according to the Fraunhofer Institute for Solar Energy Systems ISE, other cost factors are gaining importance.

Here, transport costs lead the way, currently accounting for some ten percent of the total price, based on calculations by Fraunhofer ISE and the German Mechanical and Plant Engineering Association VDMA. Moreover, if production costs continue to drop, the scales will be tipped further towards this share, making production close to target markets more attractive. Local value-added chains will render the technology cheaper and decrease dependency on imports.

However, besides manufacturing in Europe becoming more affordable for good, working conditions in China are increasingly coming into the cross-hairs. And pressure is increasing on the EU to slap punitive duties on imports of silicon, which is used to produce solar cells, or to ban them outright.

Several production sites planned in Germany

Cell specialists thus expect to see a rise in demand for European products. This has caused some companies to shift their focus and plan to build new or reactivate existing production sites. Meyer Burger Technology intends to start manufacturing solar cells and modules in Freiburg and Bitterfeld-Wolfen (Saxony) in the first half of 2021. The objective is to increase capacity from 800 megawatts (MW) at present to five GW by 2026. This will transform the company from machine supplier to highly specialised cell producer. NexWafe is another company that wants to set up its headquarters in the Solar Valley. So far, the thin silicon wafers have been the most expensive solar module components. By employing a special, low-resource method, the startup seeks to halve the price compared to that of Chinese manufacturers.

The sector is experiencing a renaissance in other countries as well. Norwegian PV system manufacturer REC Solar EMEA GmbH plans to build a large-scale factory in Hambach on the French side of the German border. The plant’s target capacity is four GW, good enough for nine million solar modules per annum. The required silicon will be mined at the company’s location in Norway.

Following the one-stop shop philosophy, newly founded Greenland, based in Andalucía, Spain, is constructing a huge factory. Production of wafers, solar cells and entire modules is slated to start there by 2030. Greenland intends to exclusively deploy state-of-the-art technology: Wafers made of monocrystalline silicon are particularly efficient, as are solar cells based on PERC technology. This entails applying an additional layer to the back of the cell, which reflects light back into the cell. Fraunhofer ISE is involved in the project.

Good arguments for companies

The scientists are exploring how to make cell production in Europe both economically feasible and sustainable. Shortening transport routes can help reduce carbon dioxide emissions, as can a green electricity mix. In addition, using cutting-edge techniques holds the promise of sparing resources.

Moreover, companies have justified hopes of receiving development subsidies from the state: Many countries have initiated subsidy programmes for the expansion of renewable energy within the scope of the European Green Deal. And the EU itself is investing in solar research, for example in project NEXTBASE at the Research Centre in Jülich where scientists are working on more efficient silicon-based solar cells.